Investing in precious metals is a popular strategy for those looking to diversify their retirement savings. However, not all precious metals qualify for an Individual Retirement Account (IRA). Understanding which metals are approved and how they fit into your investment portfolio can help you make an informed decision.

What Are IRA Approved Precious Metals?

The IRS has specific guidelines on which metals can be included in a self-directed IRA. These metals must meet purity standards and be produced by an accredited manufacturer. The most commonly approved metals include:

- Gold (99.5% purity or higher)

- Silver (99.9% purity or higher)

- Platinum (99.95% purity or higher)

- Palladium (99.95% purity or higher)

These metals must be held in an IRS-approved depository rather than stored personally.

Benefits of Investing in IRA Approved Precious Metals

- Hedge Against Inflation – Precious metals tend to retain their value over time, making them a solid hedge against inflation.

- Diversification – Including metals in your IRA adds another layer of diversification to your portfolio.

- Tax Benefits – Depending on the type of IRA you choose (Traditional or Roth), you can enjoy tax advantages.

- Long-Term Stability – Unlike stocks, metals are tangible assets that offer a sense of security during market volatility.

- Global Acceptance – Precious metals have been valued for centuries and hold intrinsic worth worldwide.

- Wealth Preservation – Metals can protect wealth against currency devaluation and economic downturns.

- Protection Against Economic Crises – In times of financial uncertainty, precious metals often perform well, providing a safe haven for investors.

- Potential for Growth – While historically stable, certain precious metals have shown the ability to appreciate significantly over time.

Best IRA Approved Precious Metals to Consider

1. American Gold Eagle Coins

One of the most popular choices for gold investors, American Gold Eagle Coins are government-backed and meet IRA standards. These coins are highly liquid and easy to trade.

Get Your American Gold Eagle Coins Today!

2. Canadian Silver Maple Leaf Coins

With a purity level of 99.99%, the Canadian Silver Maple Leaf is one of the purest silver coins available. It is widely accepted and recognized by investors worldwide.

Secure Your Canadian Silver Maple Leaf Coins Now!

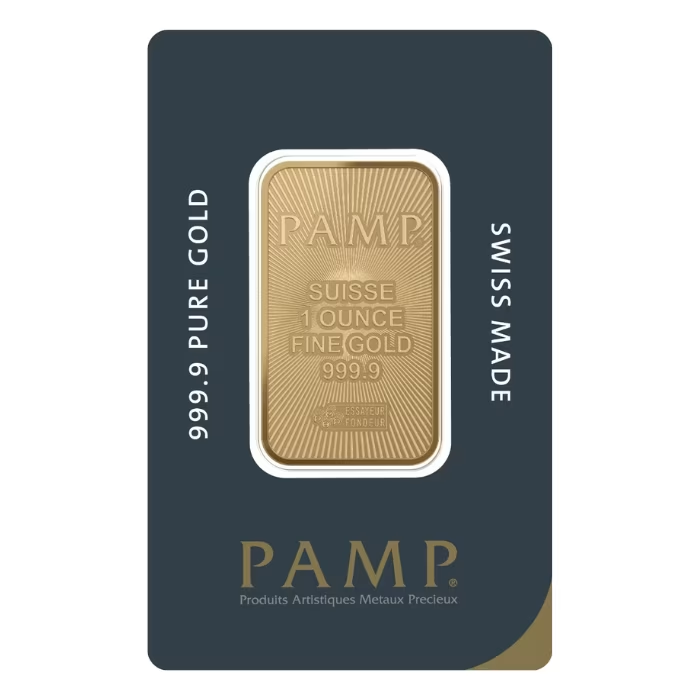

3. PAMP Suisse Platinum Bars

For those looking to add platinum to their IRA, PAMP Suisse Platinum Bars are an excellent choice. These bars are known for their high purity and come with an authenticity certificate.

Invest in PAMP Suisse Platinum Bars Today!

4. Credit Suisse Palladium Bars

Palladium is a lesser-known but valuable metal for IRAs. Credit Suisse Palladium Bars are among the most trusted choices for investors looking to diversify their holdings.

Buy Credit Suisse Palladium Bars Here!

How to Add Precious Metals to Your IRA

- Choose a Custodian – Find a self-directed IRA custodian that specializes in precious metals.

- Select Your Metals – Work with a reputable dealer to purchase IRA-approved metals.

- Store in an Approved Depository – Metals must be stored in an IRS-approved facility.

- Monitor Your Investment – Keep track of market trends and adjust your holdings accordingly.

- Stay Updated on IRS Regulations – The IRS periodically updates its policies on precious metals, so staying informed ensures compliance.

- Consult with a Financial Advisor – A professional can guide you on balancing metals within your retirement strategy.

- Consider Market Timing – Understanding when to buy and sell can maximize your returns.

- Be Aware of Fees – IRA custodians and storage facilities charge fees that can impact overall returns.

Common Mistakes to Avoid When Investing in Precious Metals IRAs

- Not Choosing an Approved Custodian – Not all custodians handle precious metals, so selecting the right one is crucial.

- Failing to Store Metals Properly – Personal storage can lead to IRS penalties; always use an approved depository.

- Investing in Non-Approved Metals – Some metals may not meet IRS standards, so always verify their eligibility.

- Ignoring Market Trends – Prices of precious metals fluctuate; keeping an eye on trends can help you buy and sell at the right time.

- Overconcentration in Metals – Diversification is key, so don’t allocate all your retirement funds to precious metals.

- Not Understanding Tax Implications – Different IRA types have varied tax benefits; understanding these can optimize your investments.

- Buying from Unverified Dealers – Scams and counterfeit metals exist, so always work with reputable sources.

- Neglecting Long-Term Planning – Precious metals should complement, not replace, other investment strategies in your retirement portfolio.

Final Thoughts

IRA-approved precious metals offer a secure and tax-advantaged way to diversify your retirement savings. Whether you choose gold, silver, platinum, or palladium, these assets can provide long-term financial stability. By understanding the rules, selecting the right metals, and working with a trusted custodian, you can maximize the benefits of precious metals within your IRA.

Investing in precious metals can provide security and financial independence, but it’s crucial to conduct thorough research, avoid common pitfalls, and seek professional guidance when necessary. With the right approach, your IRA can benefit from the stability and growth potential that precious metals provide.

If you’re ready to take control of your financial future, consider investing in precious metals today.

Start Building Your Precious Metals Portfolio Now! [Affiliate Link]